, cut down your contribution by the worth of Those people goods or solutions. If you work your deduction by lessening the FMV of the donated assets by its appreciation, as described before in

whether or not the capable organization gave you any goods or providers on account of your contribution (aside from specified token items and membership benefits),

Exception two—loved ones partnership. This disallowance isn't going to apply to a professional conservation contribution made by a family members go-by entity. spouse and children go-by means of entities are go-by entities during which significantly each of the passions are held, directly or indirectly, by a person and family members of these kinds of individual.

Lives in your home less than a created settlement in between you and a certified Group (defined afterwards) as A part of a method of your Firm to provide educational chances for the student,

I volunteer as a purple Cross nurse's aide at a medical center. am i able to deduct the cost of the uniforms I need to have on?

If contributions are created by payroll deduction, the deduction from Each individual paycheck is addressed like a different contribution.

when you spend in excess of FMV to a certified organization for merchandise or services, the surplus could be a charitable contribution. For the excess total to qualify, you should pay back it Using the intent to produce a charitable contribution.

You can not deduct a charitable contribution of a fractional curiosity in tangible own residence Unless of course all passions from the assets are held immediately prior to the contribution by:

electronic assets aren't publicly traded securities for the purposes of Form 8283, Until the digital asset is publicly traded inventory or indebtedness.

provides a claimed worth of a lot more than $five,000 and is offered, traded, or normally disposed of because of the capable Business in the calendar year in which you built the contribution, and the capable Firm hasn't designed the needed certification of exempt use (for example on kind 8282, Donee facts Return, portion IV). See also

Foreign students brought to this place underneath a professional Global schooling Trade method and placed in American households for A short lived interval generally aren't U.S. citizens and cannot be claimed as dependents.

You sail from 1 island to a different and shell out eight several hours daily counting whales and other varieties of marine lifetime. The task is sponsored by an experienced Group. In most circumstances, You can not deduct your get tax free savings for charity fees.

Enter your contributions of capital achieve residence to certified companies that are not fifty% limit companies. Do not consist of any contributions you entered over a prior line

You gave your temple a $two hundred income contribution. The Restrict dependant on sixty% of AGI will use to your money contribution towards the temple as it is an organization described previously under

Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Molly Ringwald Then & Now!

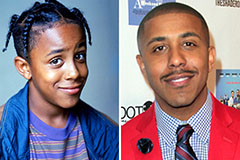

Molly Ringwald Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!